how to calculate nj taxable wages

New jersey state tax calculator tax calculator the new jersey tax calculator is updated for the 202223 tax year. Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income.

2020 New Jersey Payroll Tax Rates Abacus Payroll

Income Tax Rate Indonesia.

. March 1 2022. The fact that your W-2 already reflects the variance is a strong indicator that your company has already reported these amounts to NJ for tax considerations. Amounts received as early retirement benefits and amounts reported as pension on Schedule NJK-1 Partnership Return Form NJ-1065 are also taxable.

Figure out your filing status. How to Calculate Salary After Tax in New Jersey in 2022 Optional Choose Normal View or Full Page view to altr the tax calculator interface to suit your needs Choose your filing status. Total Taxable Wages are all taxable wages reported to the New Jersey Department of Labor by all.

New Jersey has a reciprocal tax agreement with Pennsylvania but. After a few seconds you will be provided with a full breakdown of the tax you are paying. To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Soldier For Life Fort Campbell. You must report all payments whether in cash benefits or property. Because Forms W2 issued in NJ often do not truly represent the allocation of total earnings Drake Tax is unable to just pull the total of all box 16 entries.

New Jersey state tax 2320. Ad Explore detailed reporting on the Economy in America from USAFacts. Restaurants In Matthews Nc That Deliver.

NJ1040 and NJ1040NR requires the total of all state wages to be entered. Therefore all withdrawals from a 403 b plan are fully taxable. How To Calculate Nj Taxable Wages.

However in New Jersey 403 b contributions are made on an after-tax basis Kiely said so for New Jersey income tax purposes tax basis and the rules above still. This New Jersey bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses. Essex Ct Pizza Restaurants.

In short youll have to file your taxes in both states if you live in NJ and work in NY. Using our New Jersey Salary Tax Calculator. Calculating your New Jersey state income tax is similar to the steps we listed on our Federal paycheck calculator.

Calculate hourly employees wages by multiplying the number of hours worked by their pay rate including a higher rate for any overtime hours worked. NJ AGI 50000. Calculate salaried employees paychecks by dividing their salary by the number of pay periods per year.

Wages include salaries tips fees commissions bonuses and any other payments you receive for services you perform as an employee. Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New Jersey paycheck calculator. New Jersey Paycheck Quick Facts.

Marginal tax rate 553. Add employer paid benefits taxable for qdp medical and dental ytd. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Visualize trends in state federal minimum wage unemployment household earnings more. To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. New Jersey Income Tax Table Tax Bracket Single Tax Bracket Couple Marginal Tax Rate.

Like most US States both New York and New Jersey require that you pay State income taxes. Employee A has reached the SDI taxable wage limit of 128298 for the year. The Unemployment Trust Fund reserve ratio is calculated as follows.

The new jersey income tax calculator is designed to provide a salary example with salary. Taxable Retirement Income. Tax Information Sheet Launch New Jersey Income Tax Calculator 1.

Opry Mills Breakfast Restaurants. The wages you report for federal tax purposes may be different than the wages you report for New Jersey purposes. Apply the taxable income computed in step 3 to the following table to determine the annual New Jersey tax withholding.

New Jersey income tax rate. Mandatory Electronic Filing of 1099s How to Calculate Withhold and Pay New Jersey Income Tax Withholding Rate Tables Withholding Requirements for Certain Construction Instructions for the Employers Reports Forms NJ-927 and NJ-927-W. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

In New Jersey tipped employees such as waitresses bartenders and busboys also have to factor their earned tips into their total wages as well as any tip credits claimed by their employer against their cash wages. Here is the formula for calculating taxable wages. New Jersey does include a few additional items in taxable income that are not included on either your New York or your Federal return.

Majestic Life Church Service Times. Average tax rate 331. Now to your 403 b.

You shouldnt need to have to do anything more. The filing status affects the Federal and State tax tables. Some states have reciprocal tax agreements allowing you only to pay taxes in your home state.

New Jersey has a 6625 statewide sales tax rate but also has 312 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0003 on top of the state tax. Switch to New Jersey hourly calculator. NJ-WT New Jersey Income Tax Withholding Instructions This Guide Contains.

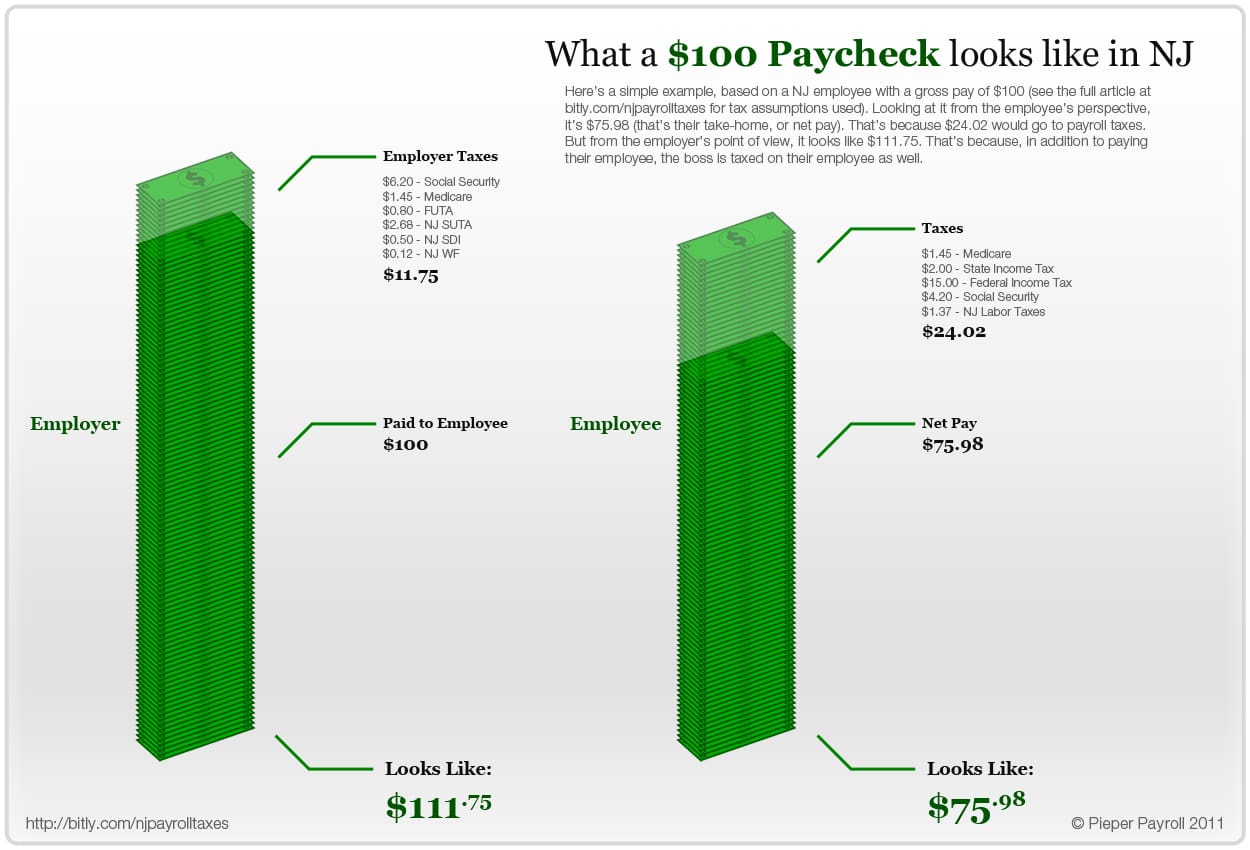

New Jersey allows employers to credit up to 737 in earned tips against an employees wages per hour which can result in a cash wage as low as 263 per hour. Gross wages - Non-taxable wages - Pre-tax deductions Taxable benefits Taxable wages. Balance of Unemployment Trust Fund total taxable wages Unemployment Trust Fund reserve ratio.

There are two main types of wages. After much discussion with NJ preparers line 15 previously line 14 will contain the LARGER of either. Taxable pensions include all state and local government teachers and federal pensions as well as employee pensions and annuities from the private sector and Keogh plans.

Total income tax -10707. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Census Bureau Number of cities with local income taxes.

Balance of Unemployment Trust Fund is the balance in the Fund as of March 31st of the current year. O the value of the cash option is not taxable by the irs. For federal income tax purposes contributions to a 403 b plan are made on a pre-tax basis.

The New Jersey income tax has seven tax brackets with a maximum marginal income tax of 1075 as of 2022.

New Jersey Nj Tax Rate H R Block

Cashing In How The New Jersey Minimum Wage Increase Will Affect Tipped Employees Citrin Cooperman

Aatrix Nj Wage And Tax Formats

Solved I Live In Nj But Work In Ny How Do I Enter State

Aatrix Nj Wage And Tax Formats

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

New Jersey Tax Rate 2017 Nj Employment Payroll Taxes

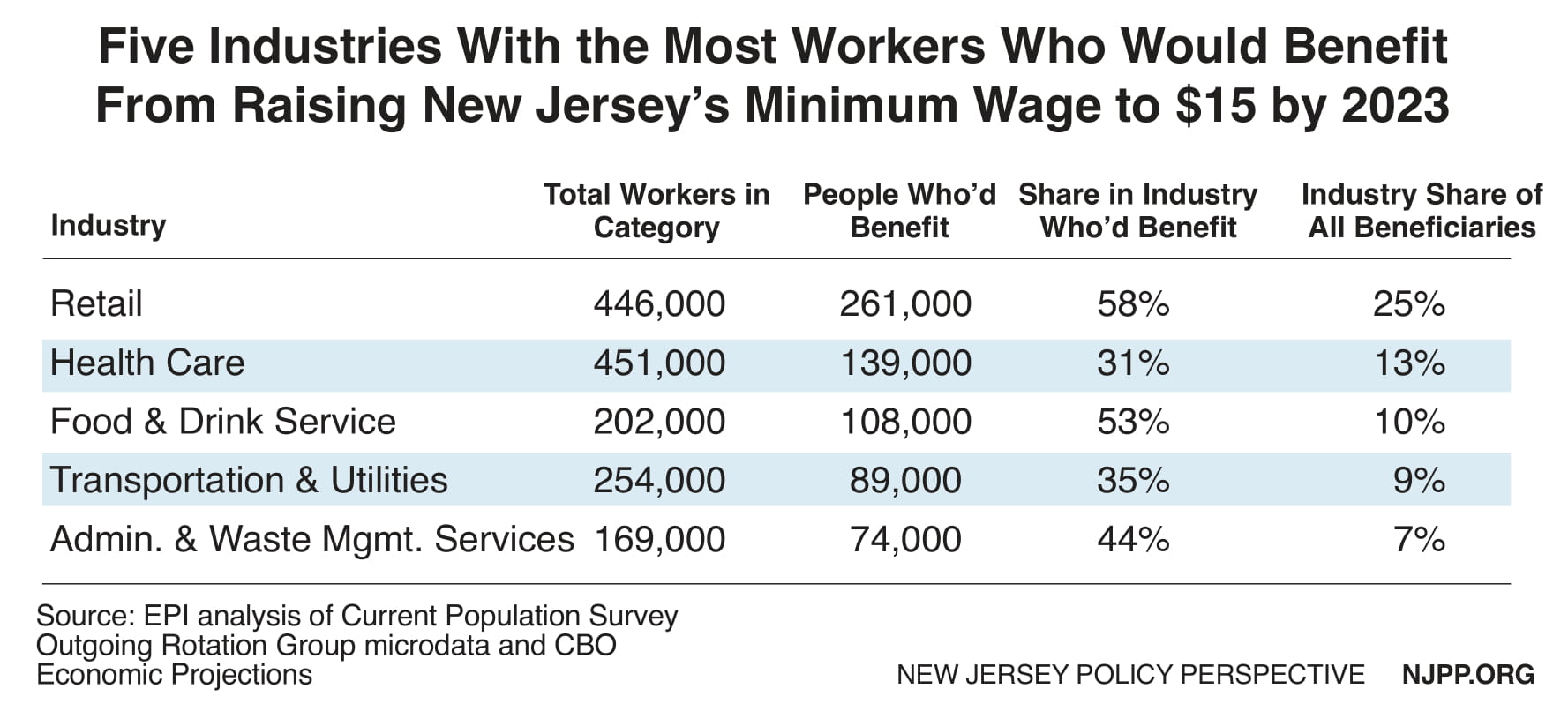

Raising The Minimum Wage To 15 Is Critical To Growing New Jersey S Economy New Jersey Policy Perspective

Solved Remove These Wages I Work In New York Ny And

Five States Ca Nj Ri Ny Hi Offer Paidleave For Temporary Disability Learn More In A New Report Family Medical Medical Leave Medical

Aatrix Nj Wage And Tax Formats

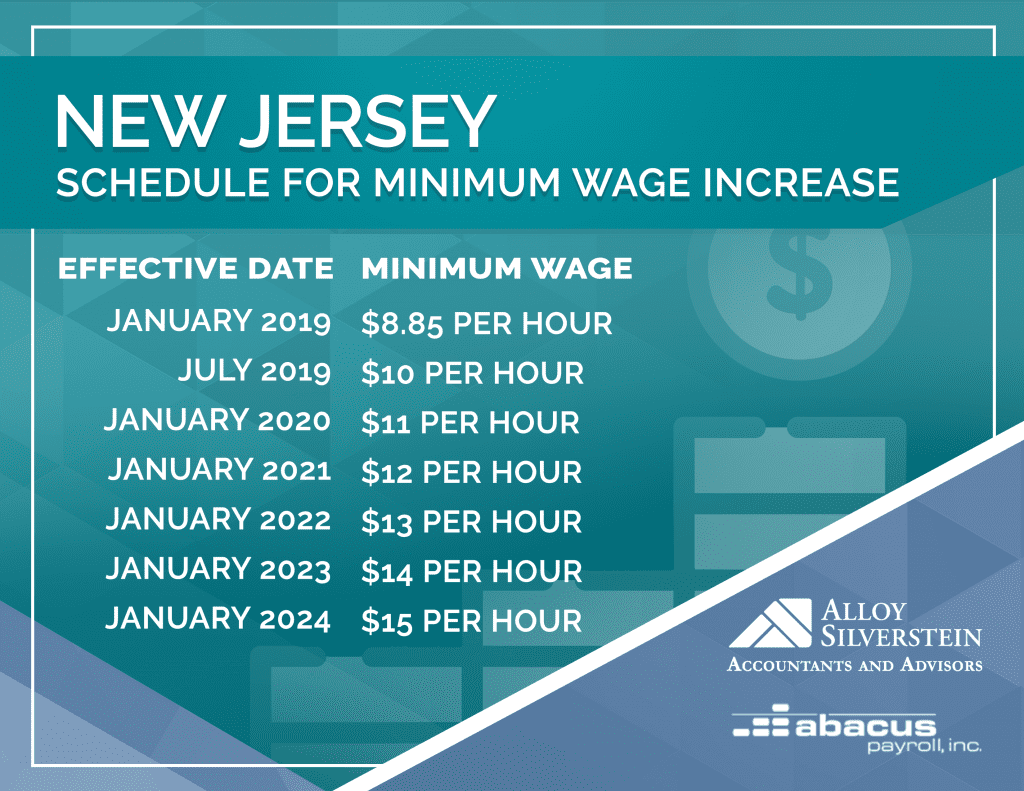

New Jersey Minimum Wage Increase Bad For Business Alloy Silverstein

Solved Remove These Wages I Work In New York Ny And

Why Does It Duplicate State Wages And Income Tax

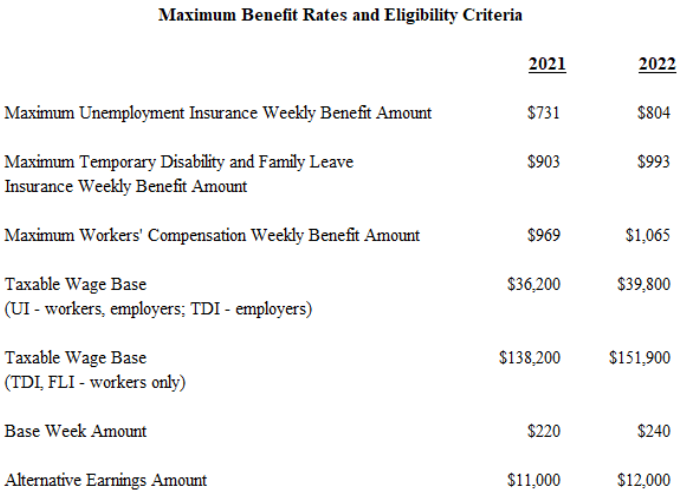

2021 New Jersey Payroll Tax Rates Abacus Payroll

2019 New Jersey Payroll Tax Rates Abacus Payroll

Department Of Labor And Workforce Development Nj Department Of Labor And Workforce Development Announces Benefit Rate Increases For 2022

Pay Stub Templates 10 Free Printable Word Excel Pdf Science Words Words Templates